Financial distress challenges even the strongest businesses, moving them through stages that test stability and decision-making. From early cash flow issues to critical points with creditors, each phase brings unique pressures. This guide outlines the stages of financial distress, the impact on business owners, and key recovery options.

Stages of Financial Distress

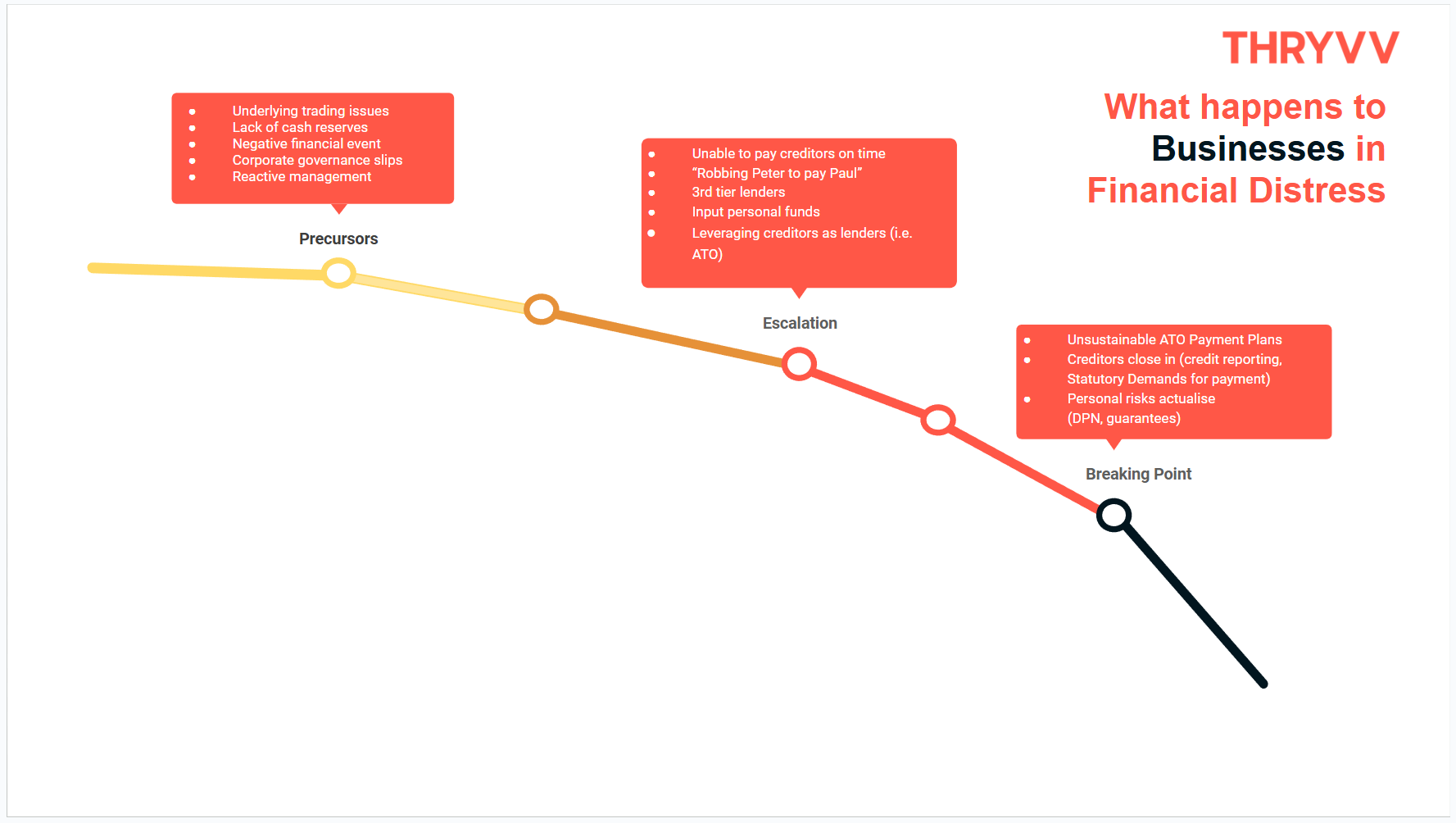

Financial distress doesn’t usually happen overnight; it progresses through identifiable stages, each with its own signs and challenges. Recognising these stages can help business owners understand where they are in the process and what steps they might take to regain control.

Here’s a closer look at each stage and the common issues businesses face along the way.

The Pre-Cursor Stage

Financial distress can initially be caused by a range of events. For example, underlying trading issues, such as declining sales or increased competition, or a negative financial event, like a significant loss or unexpected expense.

This reduction can have both tangible consequences, like a reduction in cash reserves, and intangible consequences, such as management reactively managing issues rather than proactively doing so.

The Escalation Stage

During the escalation phase of financial distress, businesses may struggle to pay creditors on time, leading to a cycle of “robbing Peter to pay Paul,” where payments to one creditor are delayed to cover another.

Companies might turn to third-tier lenders for quick cash, often at unfavourable terms, or even inject personal funds to keep operations afloat. Additionally, leveraging creditors as informal lenders, such as the ATO, can provide temporary relief but may further complicate financial relationships and obligations.

These are generally usually short term solutions as the underlying problem isn't being addressed.

The Breaking Point

Eventually, the business gets to a breaking point. When nearing the breaking point, the business may enter unsustainable payment plans with creditors and the ATO, and creditors may start to close in, sending their debts to debt collectors and issuing Creditor's Statutory Demands.

During this critical time, personal risks also start to materialize, such as and ATO issuing Director Penalty Notices (DPN) being issues and creditor's enforcing their personal guarantees, at which stage directors’ assets and reputations may be at significant risk.

Have you received a Director's Penalty Notice from the ATO?

Options When in Financial Distress

When a business is in financial distress, there are a number of options available to address the issues. However, the longer left without acting, and the further in distress the business becomes, the options available start to erode.

For example, making staff redundant may not be an option if there is not enough cash available to pay out a redundancy, or, a Small Business Restructure may no longer be available if the company is unable to pay outstanding Superannuation.

For more information on the options available when in financial distress see here >

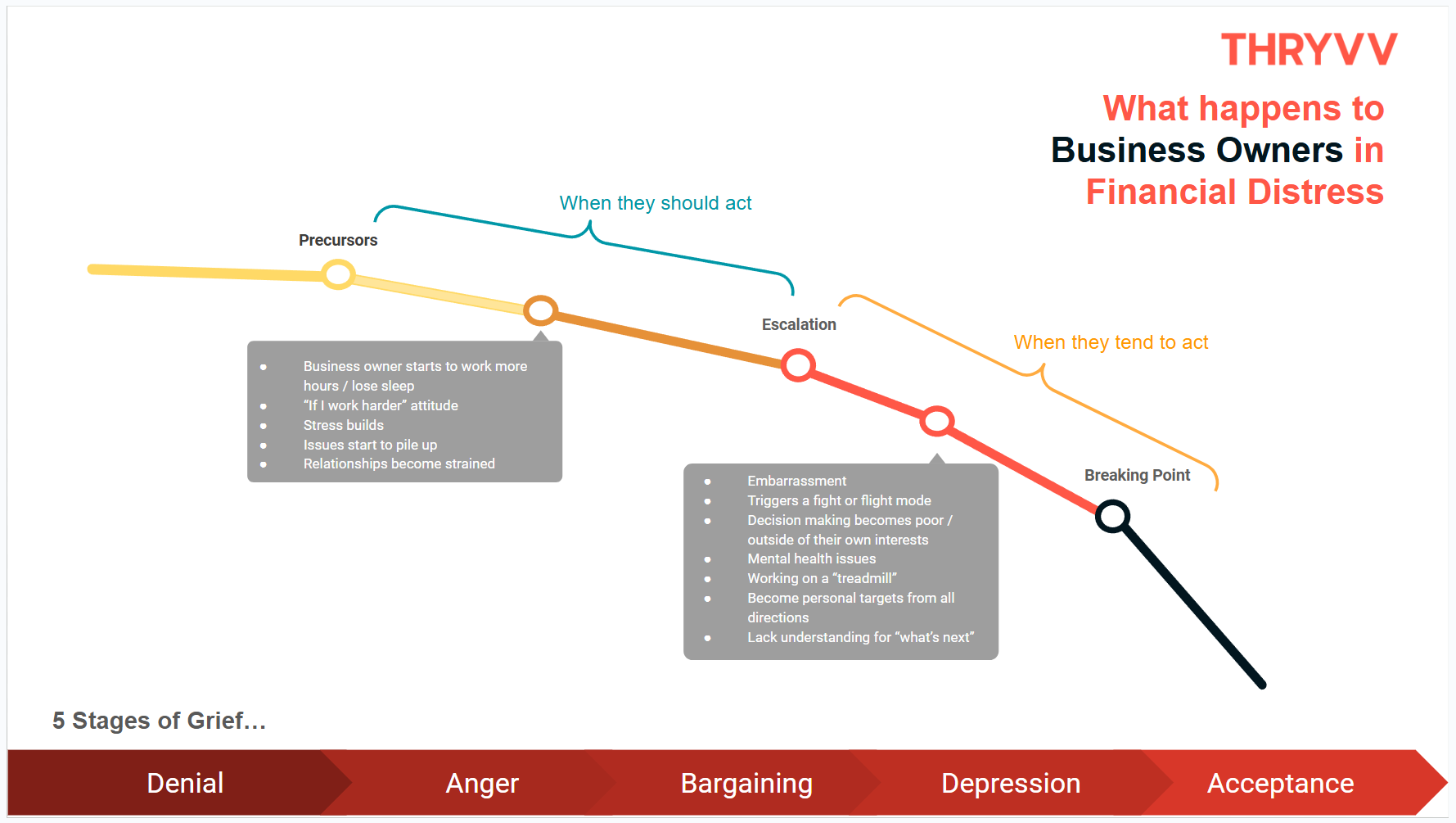

The Impact of Financial Distress on Business Owners and Managers

Financial distress doesn’t just affect a company’s finances; it takes a significant toll on those leading the business. Owners and managers face increasing pressure as they try to steer through difficult times, often at great personal cost. Each stage of distress brings unique challenges, impacting their mental health, decision-making abilities, and relationships.

Here’s a look at how financial distress affects business owners and managers at each stage.

The Business Owners and Managers in the Pre-Cursor Stage

In the precursor stage, business owners often find themselves working longer hours and losing sleep, adopting a mindset of "if I work harder" to overcome challenges.

As stress builds, unresolved issues start to pile up, creating a sense of overwhelm. This pressure can strain relationships with employees, family, and friends, as the owner struggles to manage the growing demands on their time and resources. The mounting stress and urgency for solutions can cloud judgment, making it difficult to address the core issues effectively.

The Business Owners and Managers in the Escalation Stage

In the escalation stage, business owners often start experience embarrassment, which triggers a fight-or-flight response.

Typically, the business owner has now been working long hours for an extended period of time, the psychological and neurological impact of which significantly hampers effective decision-making, where they start to make poor choices that do not align with their best interests.

Additionally, mental health issues can arise, leading to a sense of working on a “treadmill,” where progress feels elusive. They may become targets for scrutiny from creditors and others, all while losing the ability to see the path forward, lacking clarity on the next steps to take, exacerbating their stress and uncertainty.

The Stages of Grief

As the issues escalate, the business owner is also going through the stages of grief. They have poured years of hard work into the business and it is, for lack of any other definition, their child. The business is, in a lot of cases, centrally linked to their identity.

As a result, when in financial distress, the business owner needs to come to terms that the business is going through issues that it may not be able to recover from. This triggers an emotional grief response that the business owner must work through.

In simple terms, these stages are:

Unfortunately it takes time to go through this process, and it's only at the acceptance stage where the business owner will generally open up about the scale of the problem and actively seek help.

Ironically, however, the longer it takes for a business owner to seek help, the less options are available to recover from the distress.

The Best Thing to Do - Reach Out for Help

While early intervention is by far the best option available when in financial distress, we encourage you to talk to a Director's Advocate, such as Thryvv.io, regardless of what stage of financial distress you are in.

There are a number of great options that could be available to you. For example, your business could be eligible for a Small Business Restructure.

Thryvv.io offers an obligation free strategy chat, where we will help you understand your financial position and let you know what options are available to you.

Book your FREE strategy Chat >