The Definitive Guide to the Director Penalty Notice - Dealing with ATO Debt

A Director Penalty Notice (DPN) is a formal notice issued by the Australian Taxation Office (ATO) to company directors, holding them personally liable for unpaid company debts related to Pay-As-You-Go (PAYG) withholding, Superannuation Guarantee Charge (SGC), and GST (if applicable). This guide delves into the serious implications of director liability and the steps company leaders in Australia can take when facing such a situation. It's vital to understand that this isn't just a company debt; it's a personal obligation that can have significant ramifications for your individual financial standing.

If you’ve received one, it’s crucial to act quickly. In this document we break down the elements of a Director Penalty Notice, show you how to read a DPN and what actions you can take to mitigate your personal liability for tax debts.

The below sections go through a real-life GST Director Penalty Notice, with personal details redacted for privacy. This DPN is about as complex as one gets, with both non-lockdown and lockdown amounts, illustrating the different scenarios of director tax obligations.

How a Director Penalty Notice is Issued

Important Note:

Director Penalty Notices are Issued to the Director's Residential Address

DPNs are issued to the residential address of the directors per the ASIC company record.

They are not issued to your Accountant.

We encourage you to check that this record is correct in ASIC's records and immediately updated if it is inaccurate.

When issued, a Director Penalty Notice Account is created under the director’s personal ATO record. We encourage you to check this twice a week as it provides early warning of an impending DPN being issued and the potential for ATO director personal liability. You can see this account by navigating to Tax > Accounts > Summary in the director’s personal ATO portal (my.gov.au).

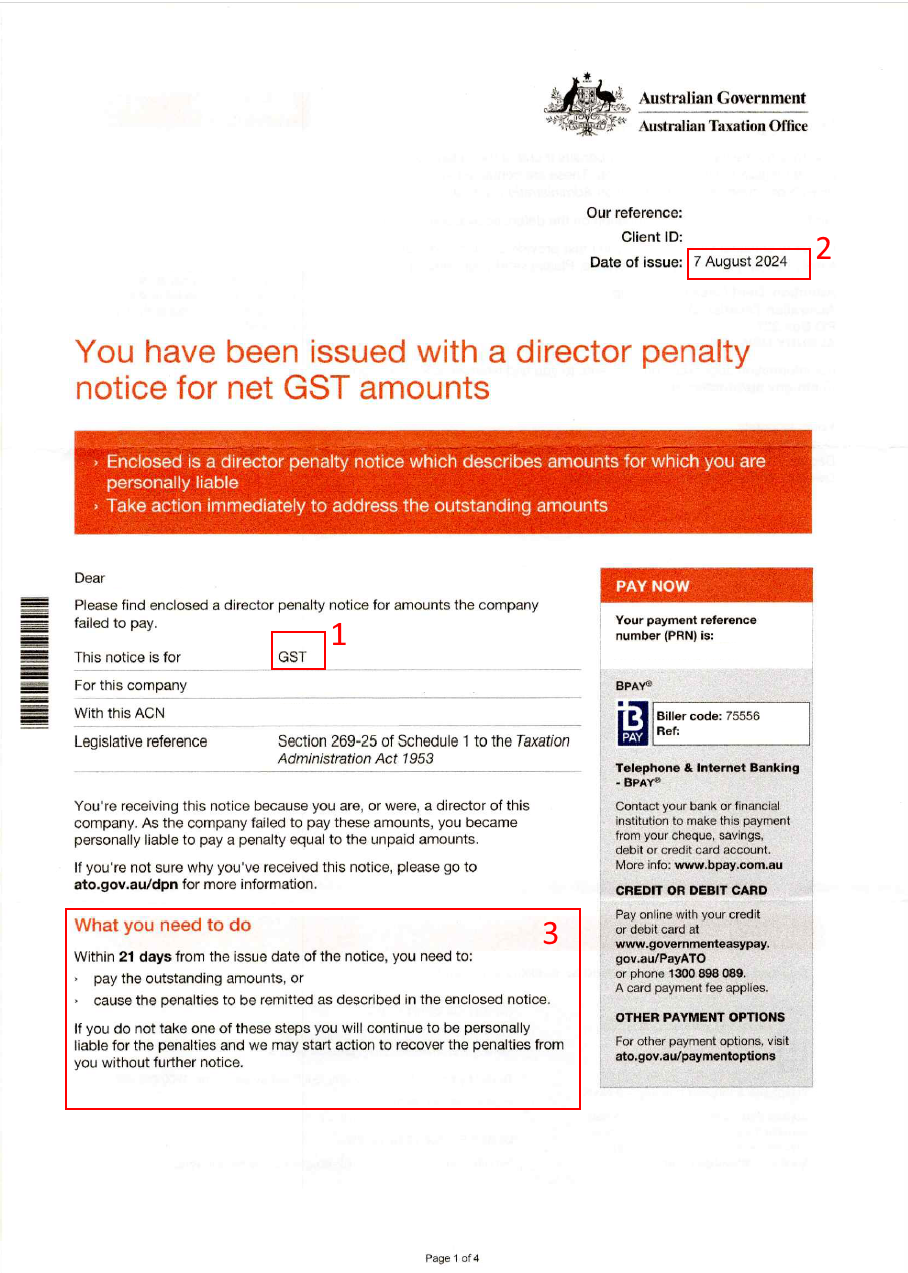

Director Penalty Notice - Page 1

The first page of a Director Penalty Notice gives a high-level summary of the DPN and the impending director's personal liability.

Label 1: Type of debt the notice relates to

The DPN shown below is for outstanding GST amounts, however there are also DPNs for Superannuation Guarantee Charge and PAYG Withholding. Each type of DPN is issued as a separate letter, so if you receive a GST DPN and there is also superannuation and PAYG withholding owing on the account, you will likely receive 3 letters in total. Generally these are issued at the same time. These are the key tax obligations that can trigger personal liability for directors.

Label 2: The date of issue

This is the date the letter is issued, and is also the date in which any time allowed to act is taken from. It's important to note that the letter may take a couple of days to reach its destination by Australia Post reducing the time available to act on it when received.

Label 3: Provides a call to action

This provides a summary of the actions available to you when you receive a DPN, aiming to address the director's personal exposure to the company's tax liabilities. This is expanded on later in the notice.

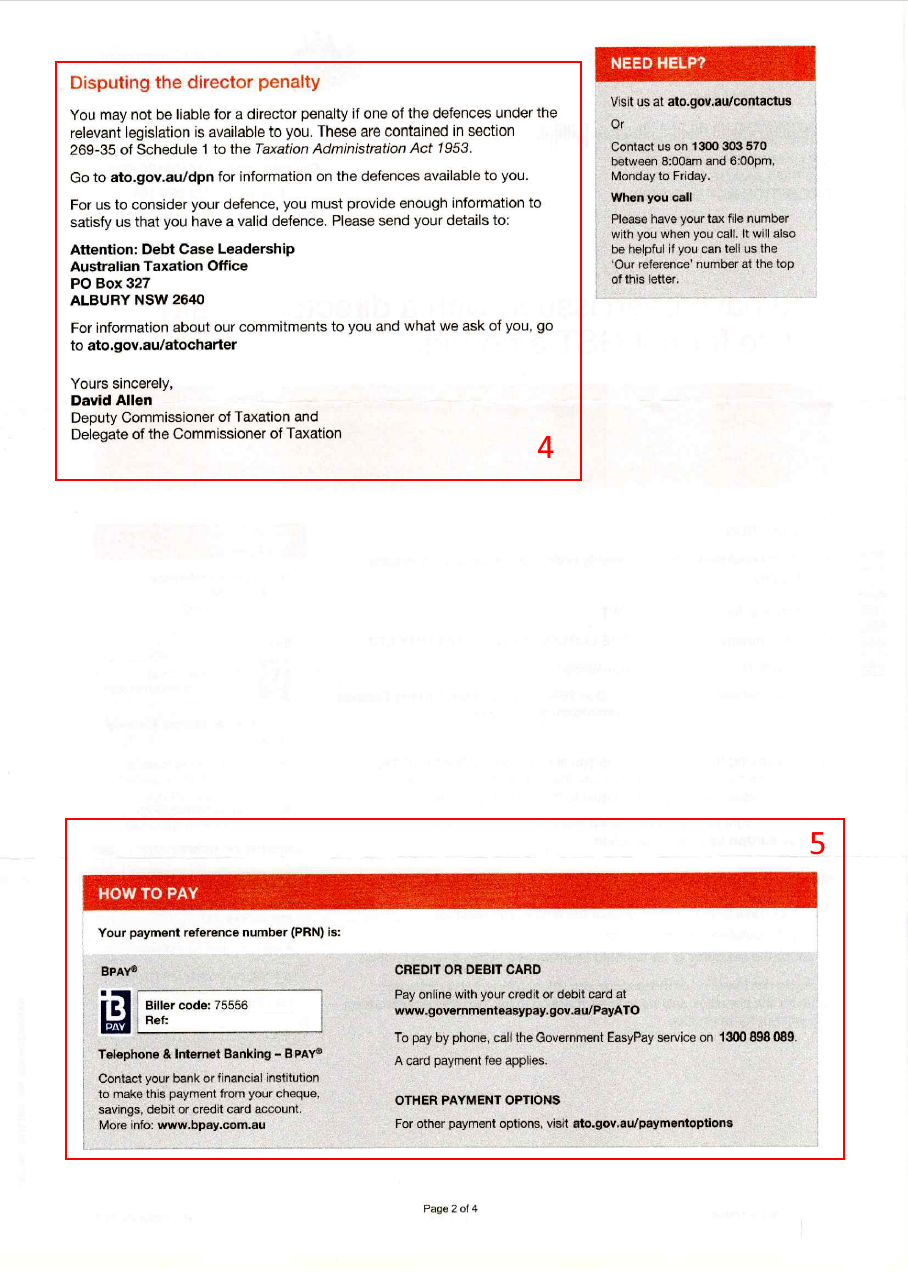

Director Penalty Notice - Page 2

The second page of a Director Penalty Notice provides an option to dispute a DPN and instructions for paying the debt, both crucial aspects when navigating ATO director personal liability.

Label 4: How to Dispute a DPN

There are a range of defences available to directors. These are generally classified into 2 areas:

- they took no part in the management of the company due to illness or some other valid reason; or

they took all reasonable steps to cause the company to:

- pay debts summarised in the DPN; or

- appoint a VA; or

- appoint a SBRP; or

- appoint a liquidator.

There may be other defences that a director can make, however unless there are substantive reasons largely outside of the director's control, the ATO will generally not agree to withdraw a DPN, reinforcing the weight of director penalty provisions.

Label 5: Pay the Debt

Of course, you can deal with a DPN by making payment in full, if that's an option available to you.

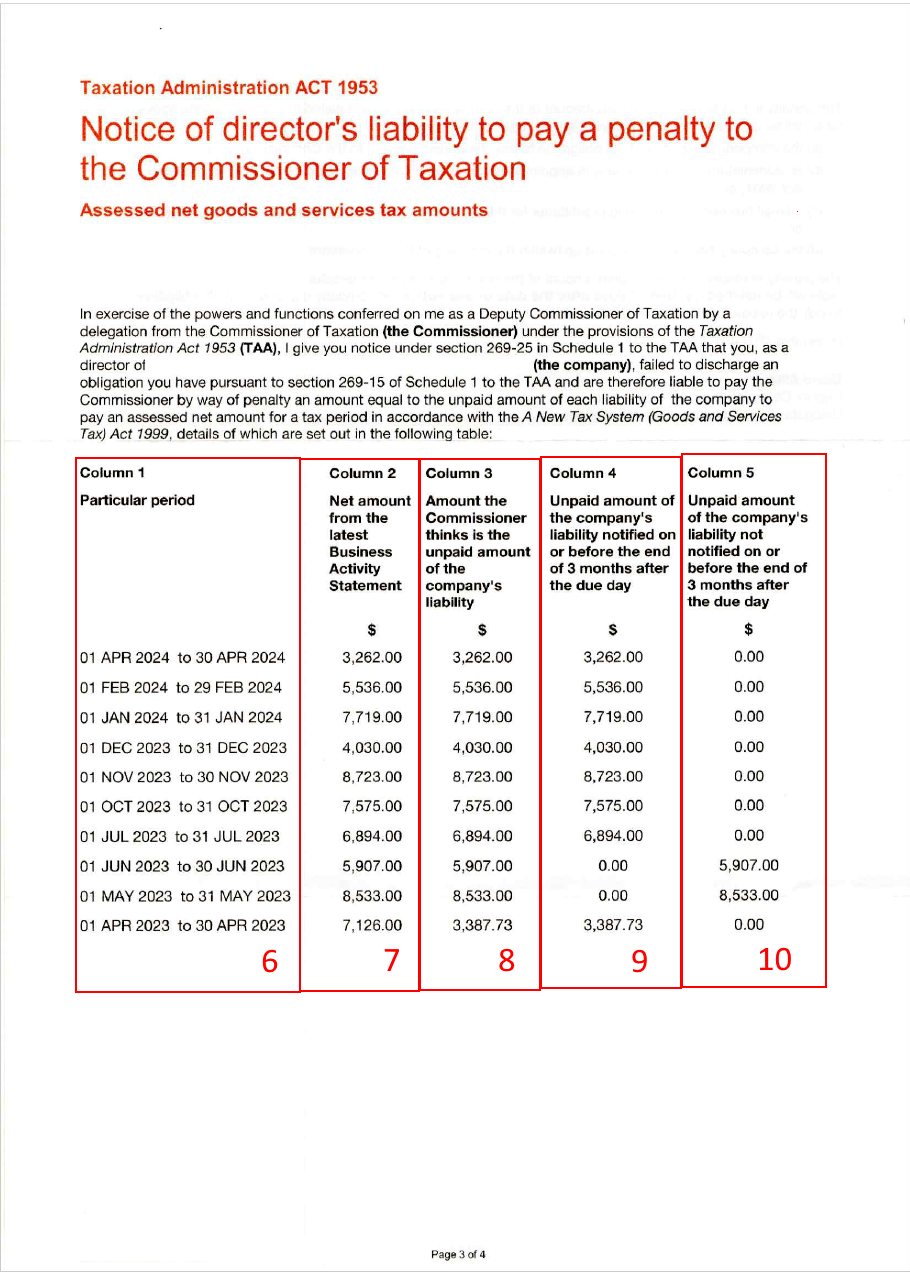

Director Penalty Notice - Page 3

The third page of a Director Penalty Notice details the specific financial periods and amounts that contribute to ATO director personal liability.

Label 6: Particular Period

Column 1 lists the periods that the DPN applies to. The ATO may not issue a DPN for the full debts, and may only issue for particular periods. This means that a director may get subsequent DPNs for periods outside of the periods listed in this DPN.

Label 7: BAS Reported Amounts

Column 2 lists out the amounts reported in the relevant Business Activity Statement (BAS) for that period.

Label 8: Amounts the ATO thinks is Unpaid

Column 3 lists out the amounts that the ATO believes are still outstanding on the date of issue of the DPN. Notice this amount can differ from Column 2 if part payments have been received or the ATO have varied the amount due to other information available to them. This column highlights the basis for the director's financial exposure.

Label 9: Non-Lockdown Amounts

Column 4 lists out the amounts that were reported on within 3 months of the due date of the BAS. Non-lockdown amounts are remitted from the director's personal account if one of the actions listed in page 4 are taken prior to the deadline date, offering a pathway to mitigate personal responsibility for company debts.

Label 10: Lockdown Amounts

These are issued where the Company's compliance history is poor with lodgements for BAS and SGC forms were not made on time and remained overdue for an extended period. These periods are as follows:

- Superannuation Guarantee Charge - the unpaid amount of the SGC obligation is reported after the due date. The due date for lodging the SGC form with the ATO is

- PAYG and GST - within three months of the due date for lodgement for BAS and IAS.

Important Note:

Lockdown DPNs

If a lockdown DPN is received, the director is made personally liable for the debt and the only option is to dispute the DPN or repay the amount.

Therefore, it's always important to lodge your BASs and Superannuation Guarantee Charge Statements on time, even if you can't pay.

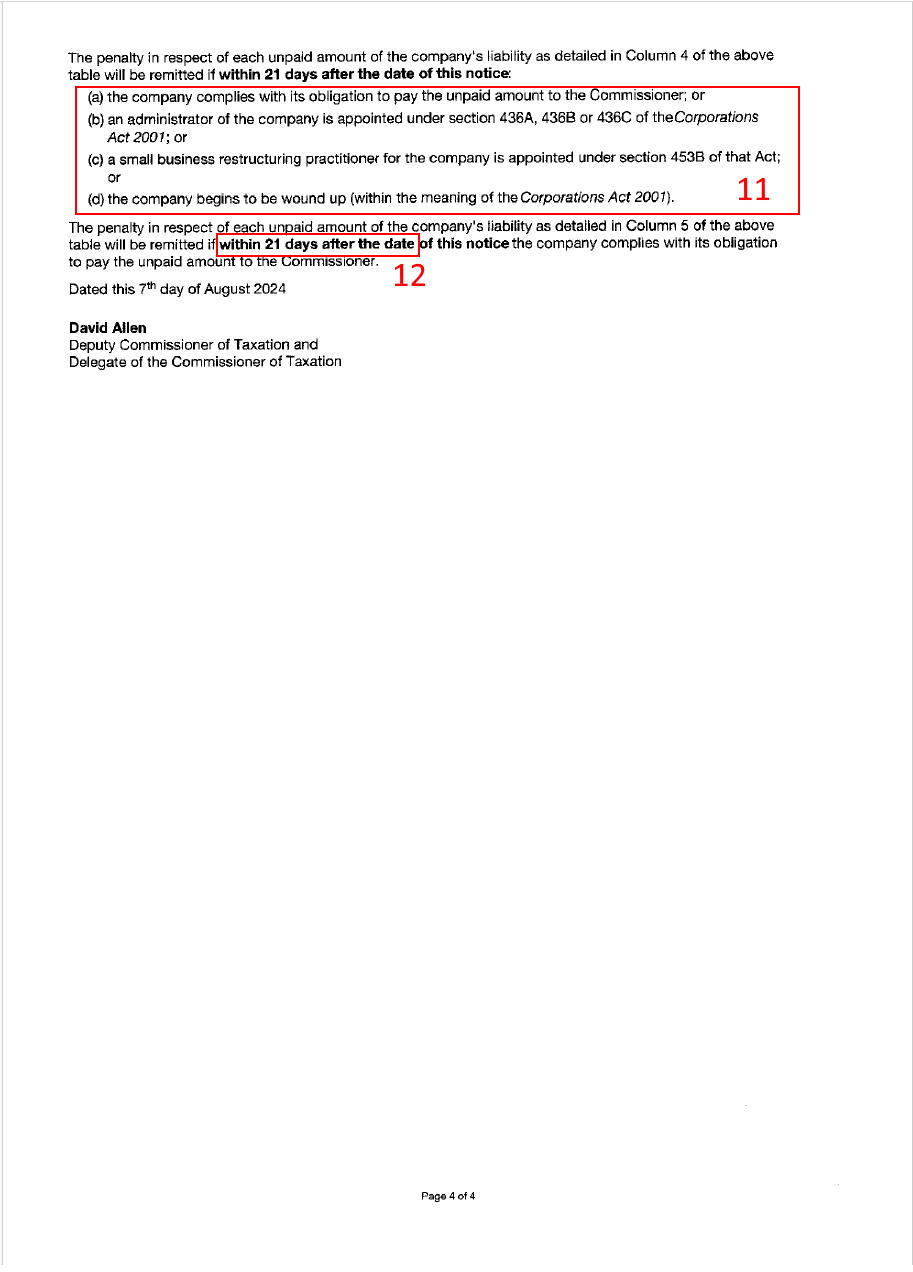

Director Penalty Notice - Page 4

The third page of a Director Penalty Notice outlines the critical actions to take to address ATO director personal liability.

Label 11: For non-lockdown DPN amounts

For non-lockdown DPN amounts, this section provides the directors with 4 options for dealing with the debts within 21 days of the date of the notices to have the penalties remitted, thereby avoiding personal financial repercussions:

- paying the debt in full

- appointing an administrator under section 436A, 436B or 436C of the Corporations Act 2001

- appointing a small business restructuring practitioner under section 453B of that Act

- the company begins to be wound up (within the meaning of the Corporations Act 2001).

Important Note:

ATO Payment Plans

You'll note that entering into a Payment Plan with the ATO is not an option provided for above and therefore does not prevent a non-lockdown DPN amount from turning into a lockdown DPN amount. This is a common misconception regarding directors' personal responsibility for tax.

You cannot deal with a DPN by entering into a payment plan with the ATO for the debt.

Label 12: Non-lockdown DPN timeframe

For non-lockdown DPNs, they usually provide 21 days from the date of issue of the DPN to act on one of the items listed in Label 11.

Given the ambiguous wording of the 21 days in the letter and stakes if not acted on in time, we generally err on the side of caution when it comes to the 21-day timeframe and treat the 20th day as the deadline date. Timely action is paramount to mitigating director personal exposure.

What to do if you receive a DPN

If you can't pay your debt in full and you receive a DPN, then you will need to move quickly to avoid further personal liability for tax debts.

For non-lockdown amounts, failing to act within the timeframe provided in the letter will mean that the amount will become lockdown, firmly establishing your director tax liability.

Important Note:

Act Quickly

Don't let DPN notices expire, it could be the difference between keeping and losing your house! This highlights the severe impact of ATO director personal liability.

The best thing to do is immediately reach out to someone who is experienced in dealing with businesses in financial distress, like Thryvv.io.

We will look at the specific circumstances and create a strategy to move forward.

Our Role: We act for you

It’s important to understand that the insolvency practitioner's job is to act for the interests of the creditors.

They have strict rules to follow, and as such are typically conflicted from providing the Company, and its director’s, holistic advice that protects the director’s interests as much as possible.

This is where we come in. Our role is to act as an intermediary between the director and the Insolvency Practitioner, ensuring that the director's interests are appropriately represented. When an insolvency practitioner makes a claim against the director's, we put together defences and negotiate on those claims on your behalf.

Book a free strategy chat with us

Book in a meeting with us to go over your options.